Can You Cash a Check Made Out to a Business?

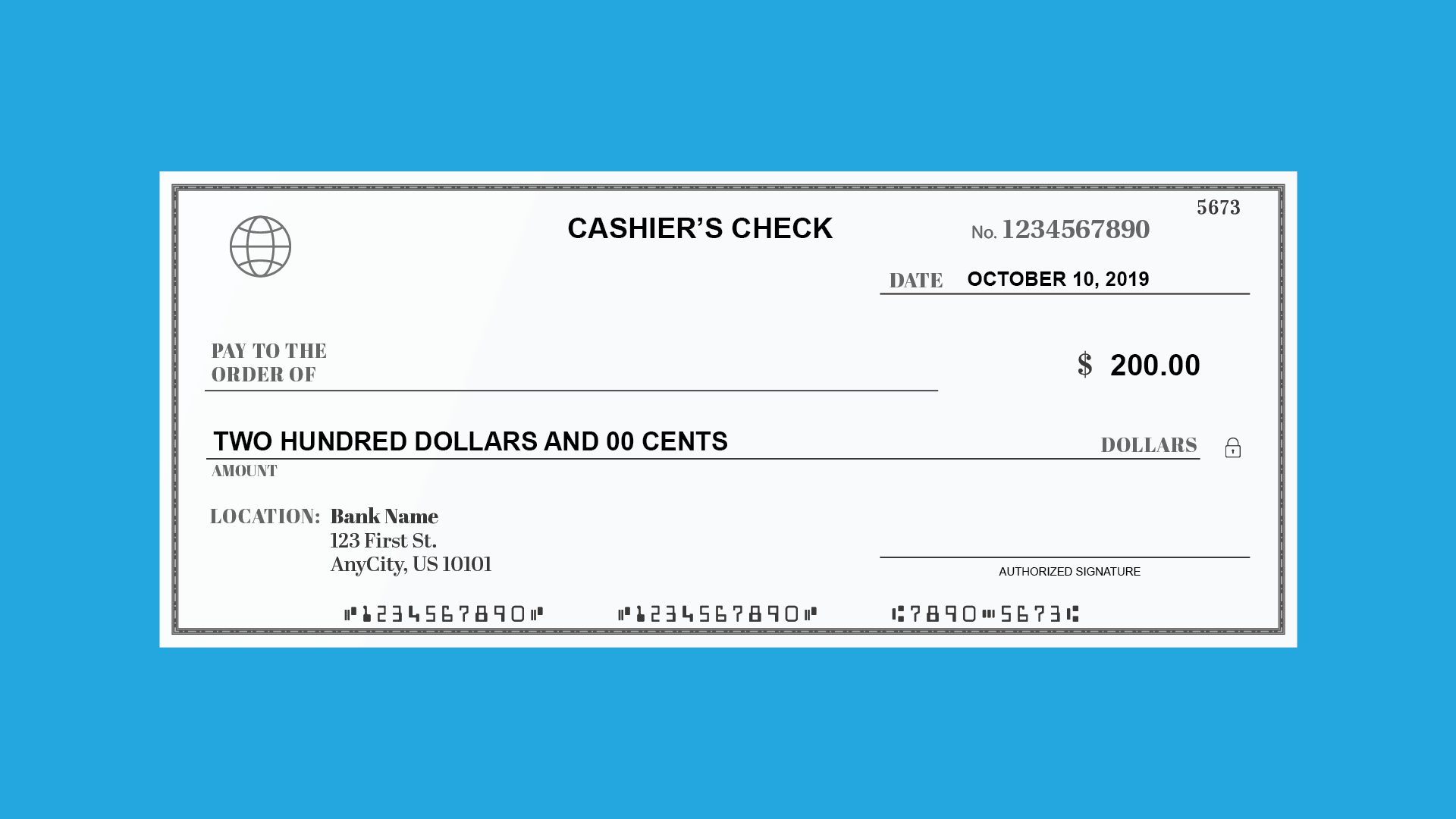

We’ve all been in a situation where we received a check but weren’t sure how to cash it because it wasn’t made payable to us. It can be frustrating, especially if you need the funds quickly. Fortunately, with a little effort and the right information, cashing a check made out to a business is possible.

Depending on the financial institution, you may be able to cash a business check with proper identification and documentation. Understanding the process and requirements is crucial, as it can vary slightly from bank to bank.

Endorsements and Bank Policies

Endorsements

To cash a check made out to a business, you typically need to endorse it. An endorsement is a signature and a statement written on the back of the check that authorizes the transfer of funds to your account. It should include your signature, the date, and a note stating that you’re authorized to receive the funds on behalf of the business.

Endorsements can come in different forms, such as “Pay to the order of [Your Name]” or “For deposit only.” Choose the endorsement that best suits your situation and ensure it’s clear and legible.

Bank Policies

Each bank has its own policies regarding cashing checks made out to businesses, so it’s important to check with your bank before attempting to cash it. Some banks may require additional documentation, such as:

- Business license or registration

- Articles of incorporation

- Proof of your authority to act on behalf of the business (e.g., power of attorney)

By providing these documents, you demonstrate to the bank that you are authorized to handle the business’s finances.

Tips and Expert Advice

Understanding the Process

Familiarize yourself with the endorsement requirements and bank policies before visiting the bank. This will save you time and potential hassle. If you have any questions or concerns, contact your bank’s customer service department for assistance.

Documentation and Identification

Gather all necessary documentation and identification before visiting the bank. This will streamline the process and minimize the risk of delays. The specific documents required will vary depending on the bank’s policies.

FAQs on Cashing Business Checks

Q: Can I cash a business check if I’m not the business owner?

A: Yes, you may be able to cash a business check if you have the proper endorsement and documentation from the business owner authorizing you to do so. The requirements vary from bank to bank, so it’s best to check with your bank for specific details.

Q: What if the business check is over a certain amount?

A: Some banks may have limits on the amount of money you can cash from a business check. If the check exceeds the limit, you may need to deposit it into your account and wait for it to clear before accessing the funds.

Q: Can I deposit a business check into my personal account?

A: Yes, you can usually deposit a business check into your personal account. However, some banks may have restrictions or hold periods for checks made out to businesses. It’s recommended to contact your bank for their specific policies.

Conclusion

Cashing a check made out to a business isn’t as daunting as it may seem. By understanding the endorsement requirements, gathering the necessary documentation, and checking with your bank’s policies, you can successfully access the funds and avoid any unnecessary delays. So, the next time you find yourself in this situation, don’t hesitate to cash that business check with confidence.

Are you interested in learning more about financial management and banking practices? If so, consider exploring our other informative articles and resources.

Image: www.thepennyhoarder.com

Image: www.gobankingrates.com

Best Places to Cash a Check While dependent on your bank, some instances may make cashing business checks more possible: If it’s a payroll business check. If you have a checking account with your bank. Your business structure will also determine the ease of cashing business checks: If you’re a sole proprietor, you’ll be the only person who can cash business checks if